Rapport

Front Line of Healthcare Report 2015: The shifting US healthcare landscape

Front Line of Healthcare Report 2015: The shifting US healthcare landscape

A look at the shifting US healthcare landscape by the numbers.

Rapport

A look at the shifting US healthcare landscape by the numbers.

For those working on the front line of US healthcare, the pace of change must seem unrelenting. Powerful forces are affecting physician practice and healthcare institutions, and this has major implications for how we pay for care, how physicians make decisions and deliver care, and how organizations purchase and use drugs and devices. Although we have been talking about change for decades, this time, the trends may be irreversible.

To better explain the magnitude of these changes, in 2015, Bain & Company fielded a national survey of 632 physicians across specialties and 100 hospital procurement administrators in the US. (For a complete description of the methodology and the questions asked in the survey, download the PDF.) This survey updates our 2011 Physician Attitudes Survey, which is discussed in the Bain publication “The new cost-conscious doctor: Changing America’s healthcare landscape.”

Our latest survey confirmed what we have long assumed to be true: The dynamics of change vary substantially across different regions of the country. To highlight these differences, we oversampled two regions that have distinct market characteristics—Massachusetts and Mississippi/Alabama. As we expected, in states like Massachusetts, the pace of change is faster because of several factors: more competition among payers and provider organizations, and an activist policy and regulatory environment that promotes change.

Increased cost pressure, technological advancements and constantly shifting regulations are creating new challenges across the healthcare industry, says Bain Partner Joshua Weisbrod. In this two-part video series, he explains how these industry shifts affect frontline employees and the medical technology and pharmaceutical sectors.

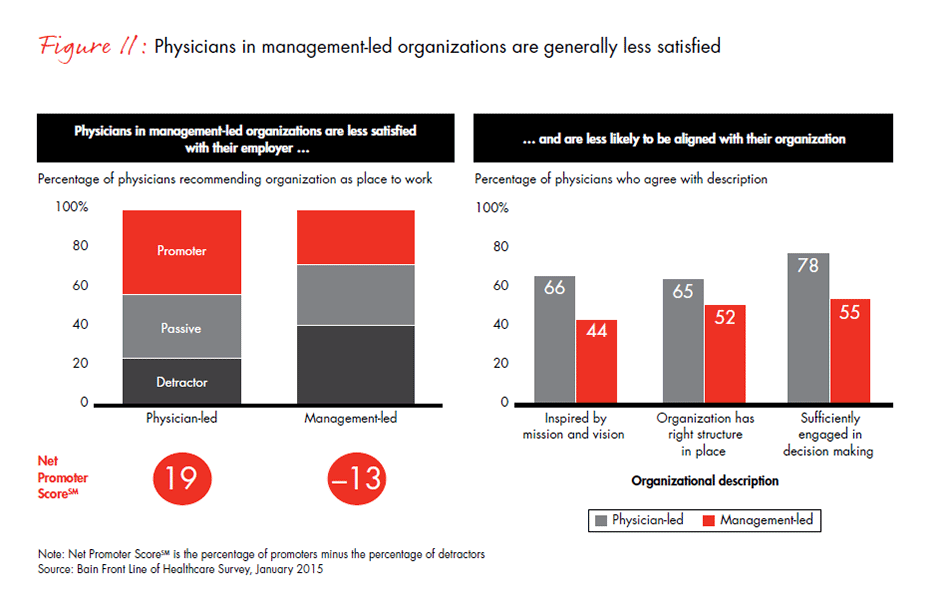

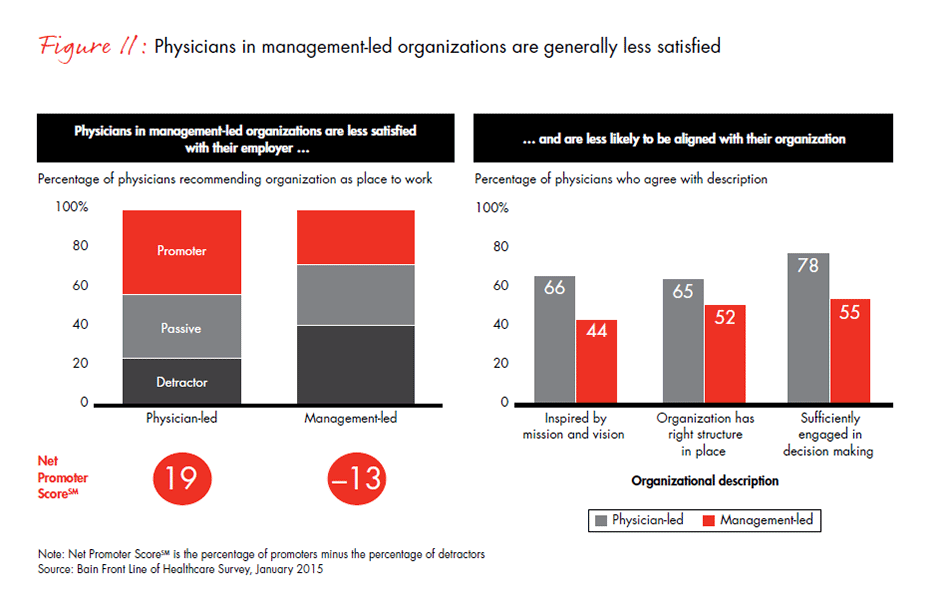

Other than the strong regional differences, the most provocative findings were the speed of change since our last survey; the growing dissatisfaction of physicians working in management-led organizations; the accelerated loss of autonomy over clinical decision making; the increasing number of surgeons who report that procurement departments exert more influence now than ever over purchasing decisions; and, for some segments of the market, the corresponding relative decline in the role of the sales representative as an information source on new products.

In this chart digest, we present the results of our survey and outline the implications for three sectors: care financing and delivery, medtech and pharma. We begin each chapter with our key findings, then illustrate the most significant survey responses with charts.

As patient care becomes increasingly systemized, more doctors say they feel less engaged and less motivated.

The financing and delivery of healthcare is becoming more systemized

While healthcare costs have slowed, in part due to macroeconomic forces, per capita costs have not decreased. Nonetheless, the effort to drive down costs and increase quality has led to a trend toward consolidation and more professionally managed organizations in many regions of the country. These organizational shifts have produced changes along a number of dimensions: increasing use of standardized clinical protocols and electronic medical records, more objective metrics for measuring clinical performance, payment models that put providers at risk for outcomes and a shift in physicians’ perceptions of their own responsibility for cost. In order to better demonstrate the totality of these changes, we combined these dimensions into what we call a “systemization index” (see Figure 1).

Larger-scale, more systematic changes are occurring, partially because previous efforts to wring out excessive cost from the system through incremental measures have been ineffective. Although the environment was already forcing change, the Affordable Care Act has certainly served as a significant catalyst to transform a delivery system that has been largely unaccountable and fragmented.

Survey respondents report that systemization has produced compelling challenges for them individually and for their organizations. These organizations are struggling to identify optimal operating models by testing new strategies and managing massive organizational transformation, all while trying to keep their clinicians engaged and aligned with their mission.

When we asked physicians how their use of analytic and clinical tools has changed over time, they responded that over the last two years, use of electronic medical records (EMRs) has nearly tripled and use of treatment protocols has more than doubled, although there are differences by region and organization type, which we highlight later on. And the percentage of physicians reporting a personal responsibility to control costs has more than doubled from a decade ago.

The trend toward larger, professionally managed organizations has also increased physicians’ ability and willingness to move from smaller independent practices to larger health systems. Why? The complexity of change and decreasing reimbursement are making private practice simultaneously more frustrating and more risky. In addition, larger systems are very interested in acquiring practices to add new access points to their overall network of care. Of physicians who switched their place of employment in the last five years, 72% report moving into larger organizations with more professional management in hopes of attaining more career sustainability—stable compensation, less risk and higher earning potential. These management-led organizations (groups owned by health systems or independent physician groups of more than 70 full-time employees) have also been leading the charge on transforming the care model. For example, in addition to increased use of electronic medical records and treatment protocols, use of treatment teams (such as care coordinators, case managers and medical homes) has more than doubled in the past two years.

The way that drugs are bought and prescribed continues to change. Here is a look at how the US healthcare landscape is shifting for pharmaceutical manufacturers.

Another dimension of systemization is the increased pressure payers are exerting on physicians and their organizations to implement risk-based payment models, like bundled payments, shared savings and capitated payments, and utilize clinical tools, such as predictive analytics or comparative effectiveness data. We found that use of these new payment approaches has increased to 69% in management-led organizations, but only to 55% in physician-led organizations. Physicians’ age is a factor in the uptake of these payment models and clinical tools as well. Younger, newly minted physicians who have been out of medical school for fewer than 15 years are considerably more likely to work in management-led organizations and use the newer tools to manage the care of their patients.

Regional differences emerged in almost every aspect of the survey. The use of electronic records and treatment protocols, for example, is higher by 28% and 11%, respectively, in Massachusetts than in Mississippi and Alabama. And in Mississippi and Alabama, physicians are 20% less likely than those in Massachusetts to report that their organization uses risk-based payment models. There are clear differences in the degree to which physicians in these states use metrics and other clinical tools as well.

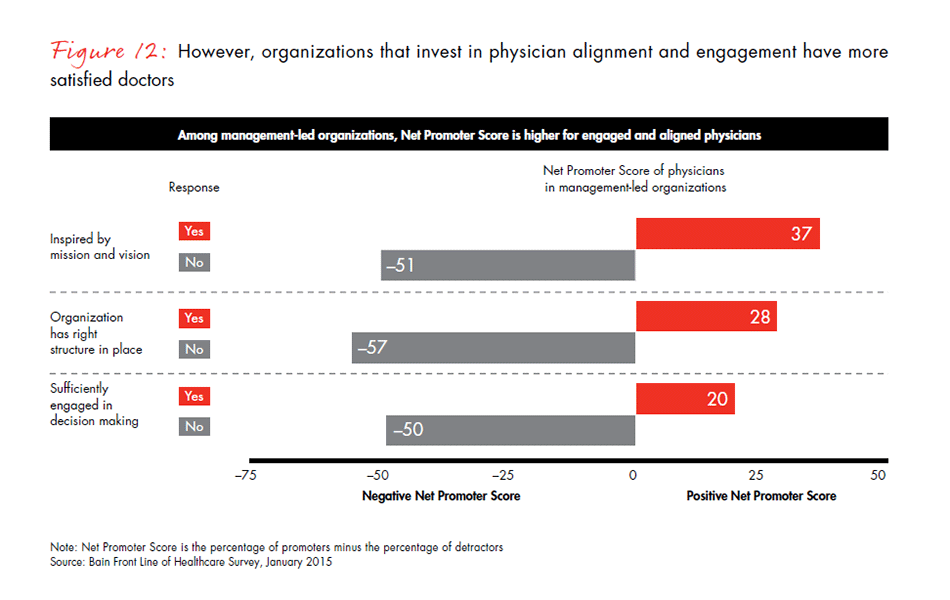

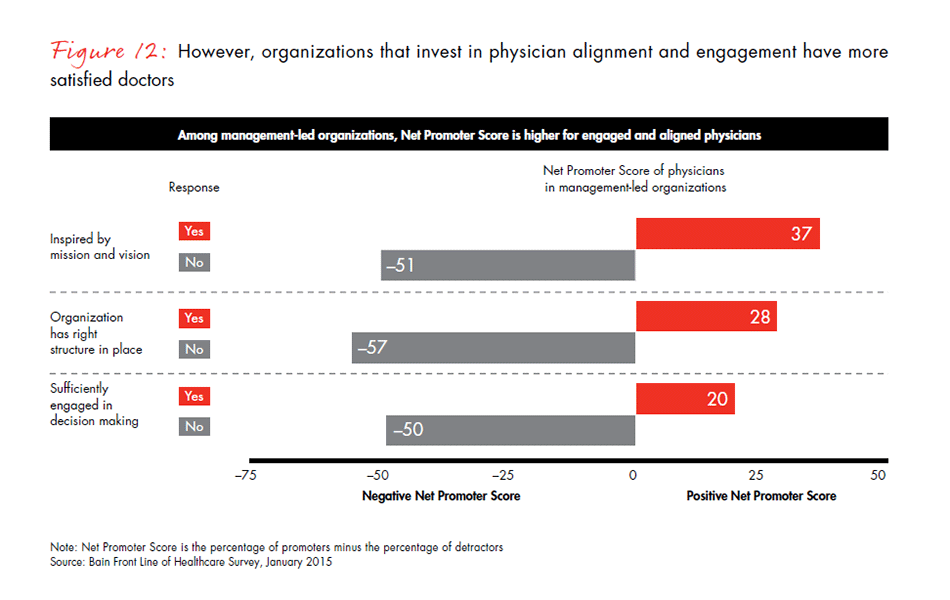

Even though more physicians are working in larger, more professionally managed organizations around the US, they do not always feel aligned with their organization’s mission. Our survey results show that physicians are moving into these organizations for stability, but they have lower levels of job satisfaction in management-led organizations. Satisfaction can be difficult to measure, so we used a tested indicator of satisfaction, the Net Promoter ScoreSM, which was developed by Bain & Company and measures whether or not physicians would recommend their organization to someone else as a place to work or to receive care. (A positive Net Promoter ScoreSM indicates physicians’ loyalty and support for their organization, while a negative score shows the opposite). We found that physicians working in management-led systems of care are significantly less likely than those in physician-led organizations to recommend their organization to others. One explanation may be that physicians in management-led organizations also report having less knowledge of their organization’s mission and being less engaged in the organization’s activities. This could be a discouraging finding for these larger health systems, but there is a silver lining: When management-led organizations take the time to engage physicians effectively, their Net Promoter Score rises dramatically, from −50 to 20.

What do these changes mean for healthcare financing and delivery organizations?

The rapid but variable pace of change in many places around the country confirms the need for healthcare delivery systems and payers to tailor their business strategies to the local market while also transforming their operating models to improve the odds of implementation success. In particular, payers need to be confident that when they shift financial risk to providers, they have the right providers with the right tools in place. Delivery systems will undoubtedly continue to merge with or acquire new entities, so mobilizing and building alignment across the entire system will be critical for success. The most important factor in building alignment between clinicians and management is engaging clinical leaders from the start at every level in the change process. As simple as this sounds, it takes a singular focus on the part of the organization’s leaders to make it happen.

The systemization of care has a direct impact on medtech and pharma manufacturers

These changes in healthcare cascade down the entire supply chain. As delivery systems become larger and more complex, decisions become more focused on outcomes and economics. Both surgeons and nonsurgical physicians report a loss of autonomy in the decision-making process, whether the decision is about which device to purchase or which drug to prescribe.

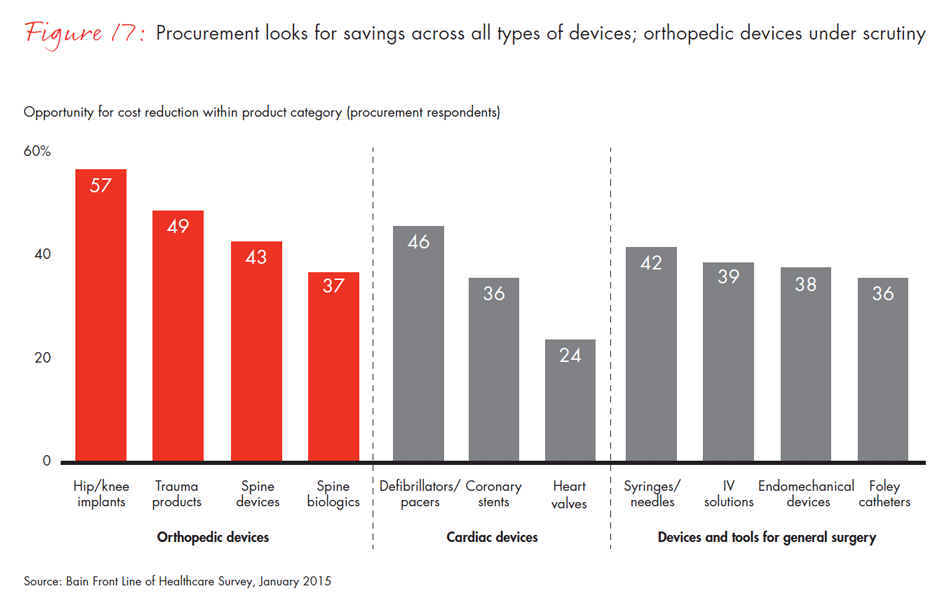

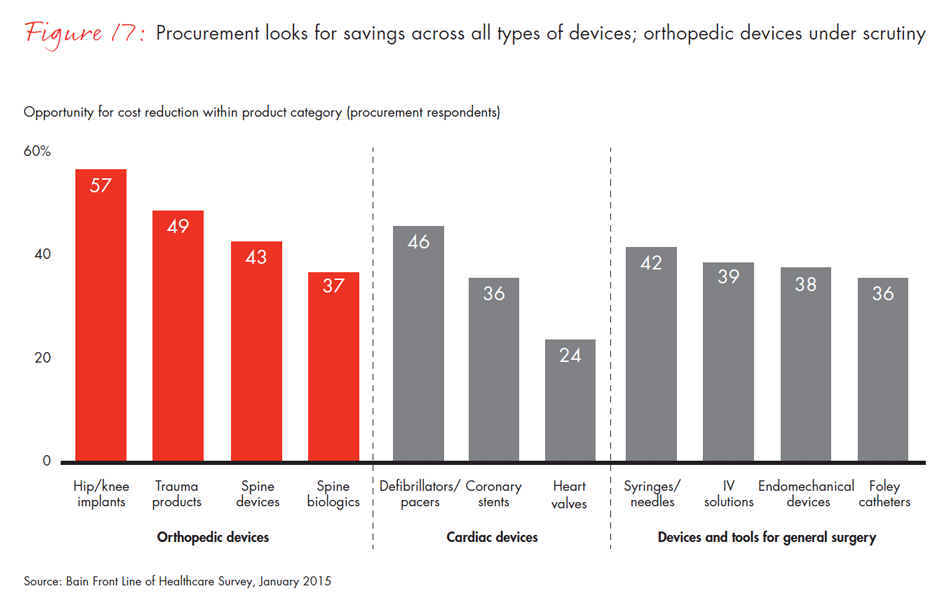

Centralized purchasing in healthcare organizations has been happening over a decade, but our results show that increasing use of preferred vendor lists by procurement departments is rapidly reducing the number of available products and putting lower-share players at risk. In fact, 40% of surgeons report they no longer use a product simply because it is not available at their hospital. The percentage of surgeons reporting that their procurement department makes most of the purchasing decisions for tools and devices has doubled in the past three years.

A look at how the US healthcare landscape is changing for medical device manufacturers.

As decision making shifts away from physicians to decisions shared with the procurement department, two-thirds of surgeons report they are pressured to go along with their hospital’s purchasing guidelines. Not surprisingly, procurement officers see it differently. Only half as many believe surgeons are pressured to cooperate. Surgeons and procurement are not always at odds, however. They overwhelmingly agree that reliability and clinical evidence are important purchasing criteria, but they diverge again on the importance of price—only 53% of surgeons believe lowest price should be an important or a very important purchasing criterion, compared with 72% of procurement officers.

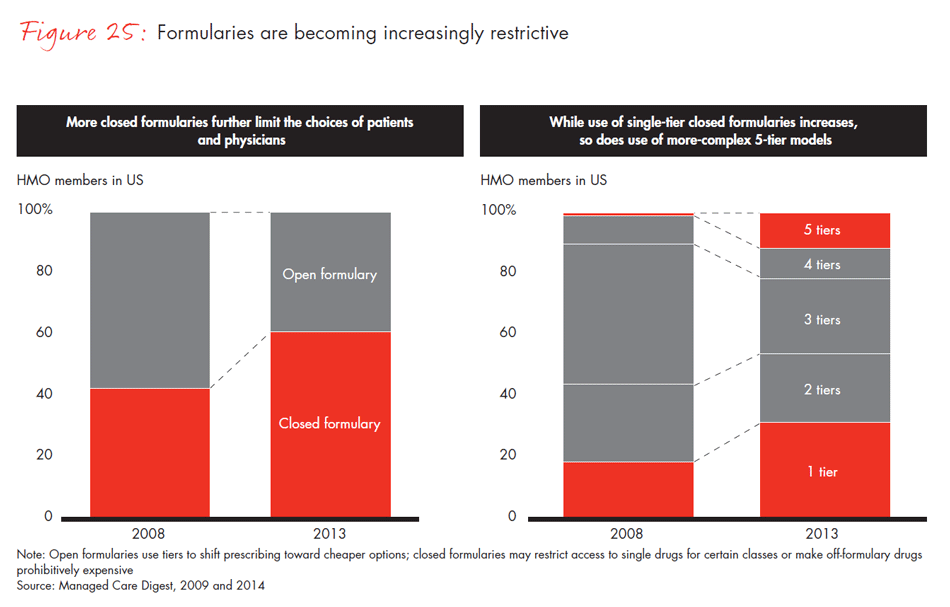

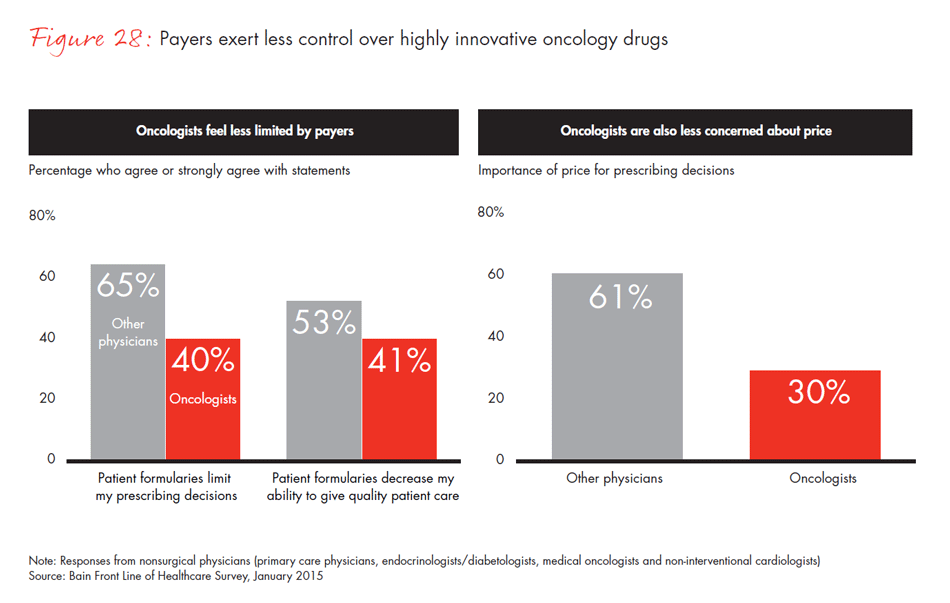

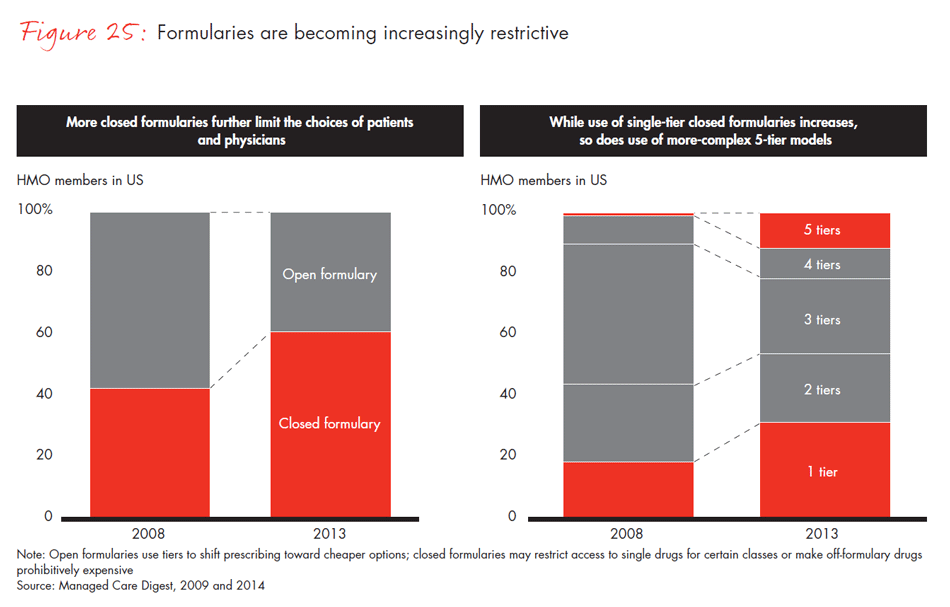

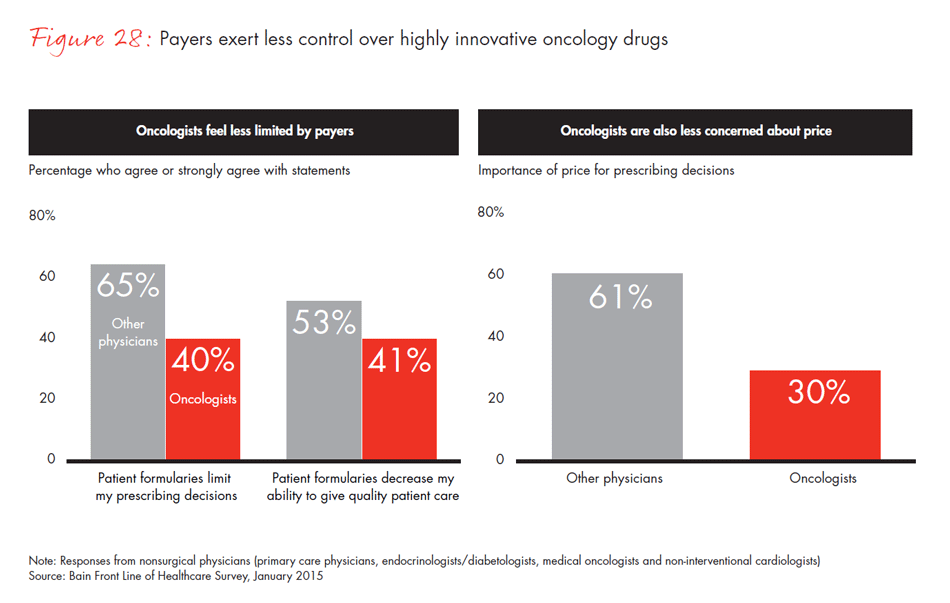

This decline of physician autonomy in decision making is also reflected in the pharmaceutical sector. Other than selected specialists such as oncologists, whose discretion over prescribing remains relatively stable because of the highly differentiated and high-impact nature of the drugs they use, physicians report more restrictions on the drugs they can prescribe. They report that there are more hoops to jump through to gain approval for the more expensive products. Two-thirds of physicians say that formularies limit their decision making, and about half feel those formularies affect the quality of care they are able to provide to patients.

These shifts in decision-making power also have implications for where physicians and surgeons obtain information about new products. Traditionally, sales representatives have been a common and highly valued source of information. Increasingly, though, we find that physicians rely on manufacturer websites, academic journals and conferences. Only 41% of physicians in our survey report that sales reps are one of their top three sources of information about a new drug, compared with 56% three years ago. This is also true for medical devices, with 48% of surgeons reporting that sales reps are an important source of information, down from 59% three years ago.

Sales reps are not entirely out of business, however. The dependence on reps varies by physicians’ age, specialty, type of organization and region. Of surgeons in Alabama and Mississippi, 69% rate sales reps as one of their top sources of information, compared with only 31% in Massachusetts. More experienced physicians, orthopedic surgeons and cardiologists, or those who are self-employed, also report a higher reliance on sales representatives.

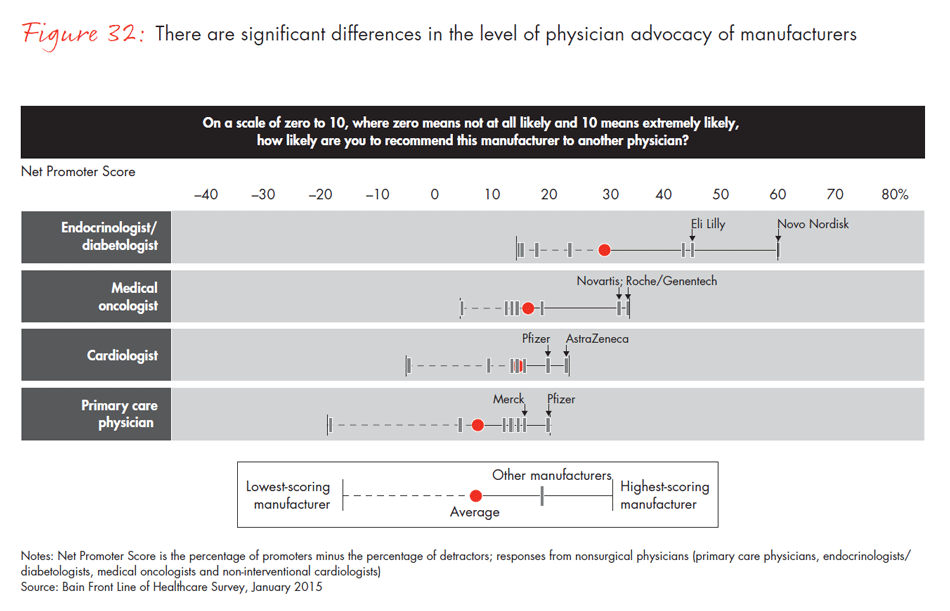

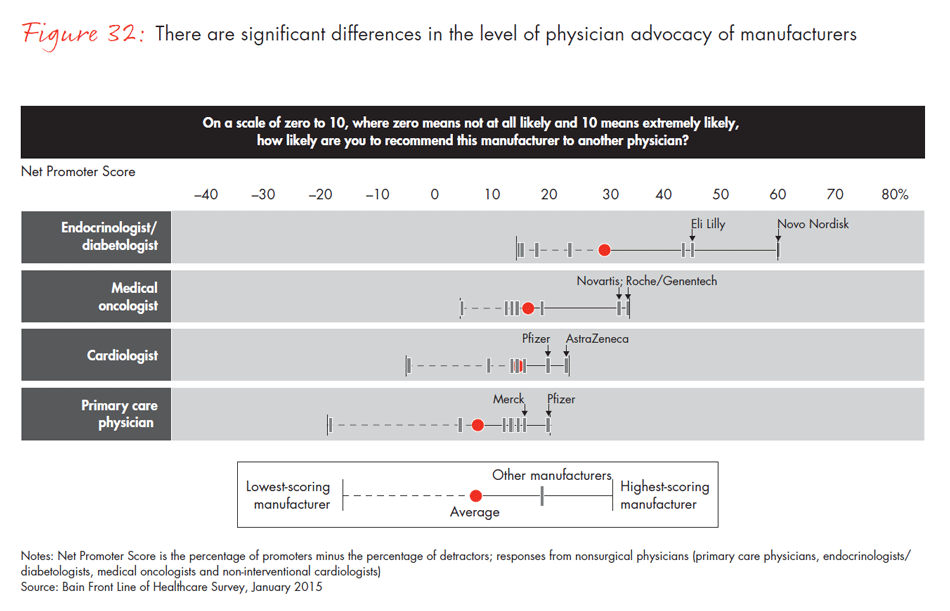

In a world of intense competition, how do manufacturers differentiate themselves to physicians, surgeons and procurement officers? Companies whose category leadership is strong—that is, companies with the largest market share within a physician’s area of specialty—had the highest Net Promoter Scores and were more likely to be identified as the company best positioned to meet unmet needs. In other Bain research, we found that category leadership generates clear benefits and better financial performance. Our survey reinforces those findings: Physicians are most likely to recommend the leader in a category and view that company as the innovation leader—a dynamic that continues to strengthen the position of those that are able to achieve and sustain leadership.

What do these changes mean for medtech and pharma companies?

Medtech and pharma companies know that the purchase and sale of drugs and devices is becoming more competitive and centralized in hospitals and drug benefit plans. Our survey results show that surgeons still have discretion in the decision-making process, but procurement departments have increasing power as economics becomes an increasingly important criterion. Sales representatives will need to adapt to serve a more sophisticated customer, although their role still varies by segment, medical specialty and market. To meet these new challenges, manufacturers will need to develop more sophisticated and flexible go-to-market models that reflect these regional and practice differences. The winners will be those product companies that can achieve flexibility while minimizing the complexity of their operating model. Manufacturers should note that category leadership continues to matter more than breadth in a company’s portfolio when it comes to loyalty and advocacy.

Change is a given … but what direction will change take, and how will it affect those on the front line? Uncertainty is also a given, with questions about policy, payment and pace dominating the discussion. Will payers and procurement departments continue to emphasize economic decision making, or will we see a slowdown or even a backlash? Will organizations grow and merge more rapidly, or will physicians retreat to individual and small group practices? Bain will continue to conduct periodic surveys to measure what is happening on the front line of healthcare in order to help companies adjust and compete.

1. Care financing and delivery

3. Pharma

For more information about the methodology and survey questions, download the PDF.

This report was prepared by Tim van Biesen, Josh Weisbrod, Roger Sawhney and Julie Coffman, who are partners with Bain’s Healthcare practice. Julie Coffman is a partner with Bain & Company based in Chicago; Roger Sawhney, Josh Weisbrod and Tim van Biesen are Bain partners based in New York. Tim leads the firm’s Americas Healthcare practice.

The authors wish to give special thanks to Ben King for his work on this report and to the team he led, including Gautham Iyer, Lauren Brom, Julie Berez, Lauren Christman and Prilla Schenck. Additional thanks to Jason Schechter for his research, Gary Dispensa for his guidance and Linda Bergthold for her editorial support.

Net Promoter SystemSM and Net Promoter ScoreSM are trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.