Brief

In evidenza

- The UK has a goal of net zero greenhouse gas emissions by 2050.

- Multiple obstacles exist in achieving this goal, including cost, consumer buy-in, system capacity, security concerns, and key stakeholder cooperation.

- We have a long road ahead and must begin planning now to achieve our net-zero goal.

A friend recently took the leap and purchased an electric vehicle (EV). With excitement and trepidation, she drove out of the dealership’s lot with her new car, wondering how she was going to recharge it—you can get the Electric Vehicle Homecharge Scheme (EVHS) grant to install a home charger only after you’ve actually purchased a vehicle. A start-up company installed her home charger, and it was a stellar customer experience. But then she had to deal with the utility companies, and that’s when the problems started.

It turned out that she needed to replace her mains electrical power head (the connection from her property to the electrical network). However, you cannot talk to your local distribution network operator (DNO) directly; you must go through your retailer. Retailers have no idea how to generate the correct industry “data flow” for an EV issue, and her DNO was quick to claim that upgrading the end point of their network to be compatible with the 21st century wasn’t their responsibility. Even when the DNO finally agreed to the mains head replacement, there was no one at the company to actually schedule the job. After numerous calls, many email exchanges, and three separate crew visits, it took a total of nine months to get her home EV charger working!

In the meantime, relying on street charging was yet another maze to navigate. You need a separate subscription with each service provider and a physical RFID card or smartphone app to use a public charging station. And, at least in her neighbourhood, there simply aren’t enough charging points for the growing number of EVs.

The UK recently set an ambitious target of net-zero carbon emissions by 2050. The electricity sector will play a critical role in the transition to net zero—not only in decarbonising the existing electricity system by increasing wind, solar, and other forms of green energy, but also by supporting the decarbonisation of other sectors through electrification. This initiative will fundamentally change how we use and interact with the electricity network.

The transition to net zero won’t be smooth sailing. Our friend’s EV ownership experience is just a microcosm of the practical barriers that will have to be overcome along the way.

Many barriers exist in meeting the 2050 goal

In just the electricity sector, the path to net-zero emissions is unprecedented in both the extent and complexity of the required changes. Various approaches will be necessary to achieve a balanced net-zero pathway by 2050 (see Figure 1).

Some of the necessary changes in the electricity sector include:

- Generation of electricity will shift from 40% fossil fuels today to 90% renewable energy and nuclear power by 2050.

- Electricity generation, storage, and balancing will radically decentralise, moving from hundreds of players in the system today to millions by 2050.

- End customers will transition from being pure consumers to also becoming generators and sources of storage, and will be asked to play a role in system balancing.

- Today’s one-way network with a top-down flow from supply to demand will shift to a dynamic, smart, two-way system, with a need for frequency and load balancing on both a national and highly local level.

- Data sources, data flows, and data analytics will increase exponentially—as will the need for system security.

Net-zero electricity generation must be financially incentivised

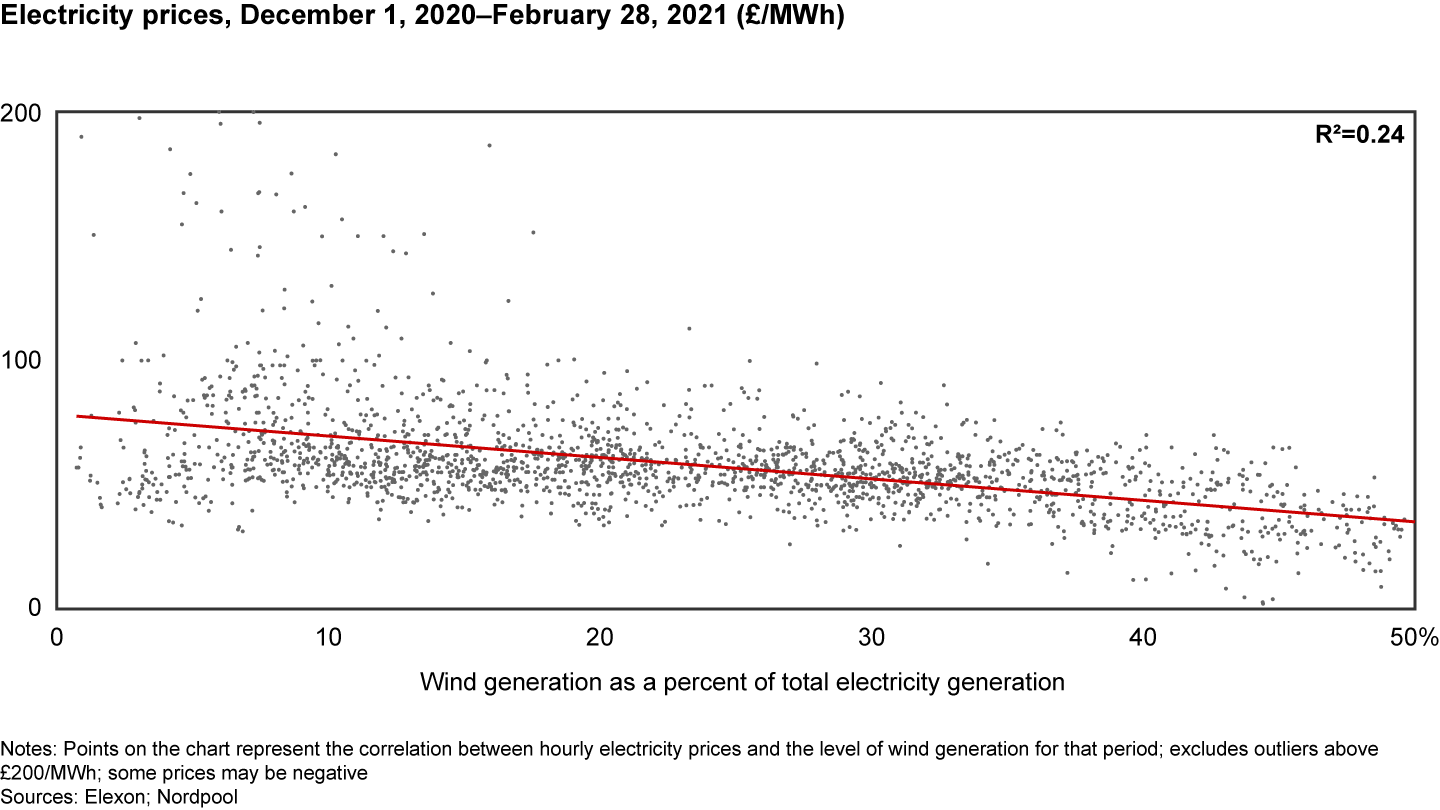

As electricity generation shifts to mostly low-marginal-cost sources such as wind, solar, or nuclear power, the electricity system—which is based on short-run marginal cost—will become increasingly ineffective. We’ve already seen an increase in price volatility, high bid-ask spreads, negative prices, and negative correlation between renewable output and price levels (see Figure 2). These issues will only become worse as the eight gigawatts of intermittent renewables currently under construction becomes operational.

By continuing on the current path, we run the risk of providing insufficient long-term incentives for investments in low-carbon electricity generation. We also increase the risk of raising the cost of the energy transition, which is driven by high uncertainty risk premiums. The market overlays that have been introduced to address those incentives, such as contract for difference (CFD), the capacity market, and direct support for nuclear energy, are moving the market further away from its original design and risk supporting specific technologies, while reducing opportunities for innovation.

In addition, specific elements of Great Britain’s policy framework are in conflict. For example, delivering this transition at the lowest cost to the customer, given the updated process for Round 4 of the offshore seabed auction, led to an astonishing £879 million raised from option fees per year. The companies developing offshore wind will be bidding to receive CFD support in the future. And when pricing returns for investors, these companies will inevitably add in these option fees, which will be reflected in higher consumer electricity prices. The overall cost of the energy transition will also increase for consumers.

Whole system costs must be optimised

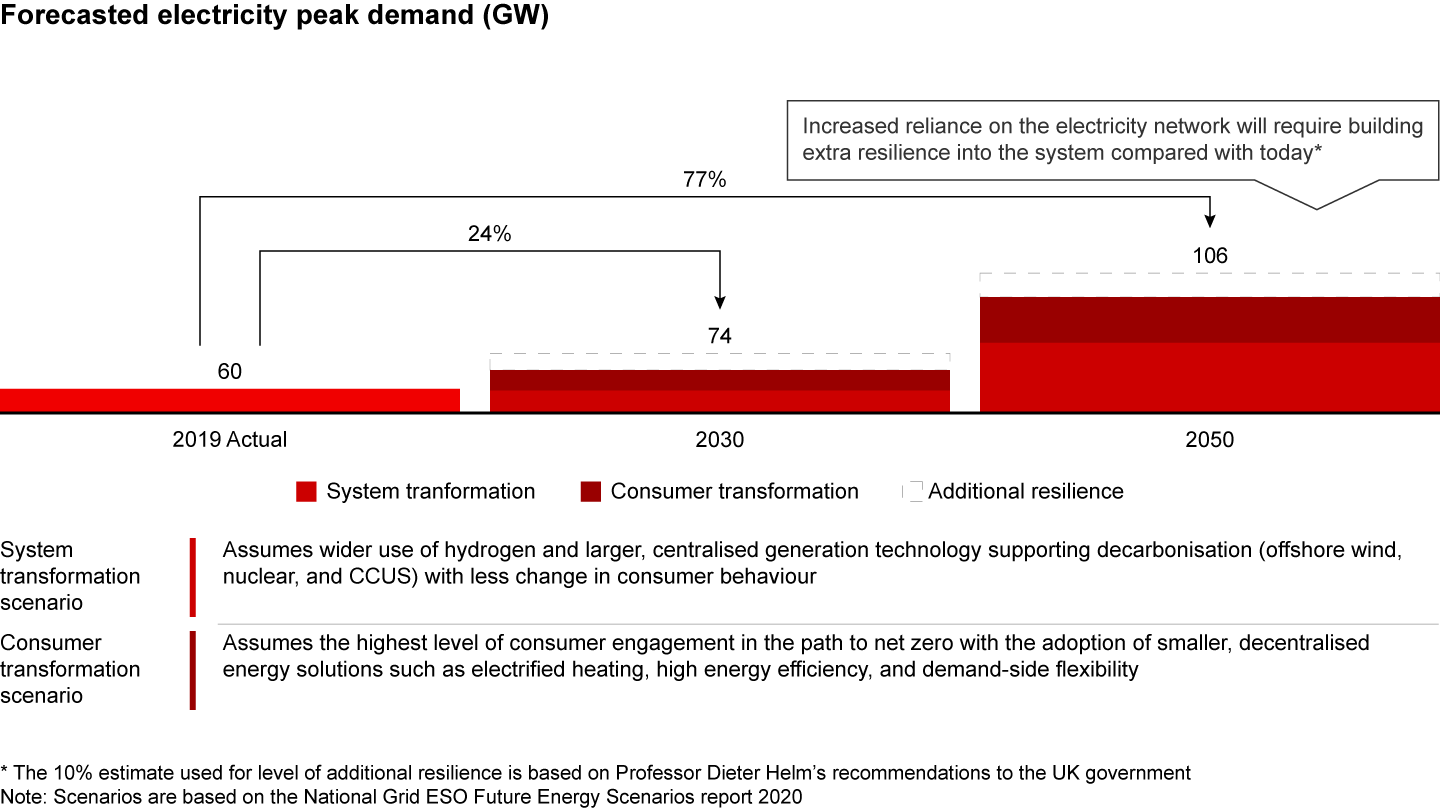

Electrification of heat will fundamentally change the profile of electricity demand. The whole heating system will need to accommodate the winter peak of both traditional electricity usage and the transition from gas heating. Such reliance on the electricity grid will also require an increased level of network resilience—all adding up to a cost to society as a whole. Future energy scenarios indicate that peak demand could rise by 20% to 80%, requiring investment in electricity transmission and distribution networks to cope with such an increase in demand (see Figure 3).

At the same time, there’s no clear accountability for the whole system design or whole system cost. Such an approach would incorporate options like network planning, localised electricity or heat storage, seasonal long-term electricity storage, higher usage of heat networks, and hydrogen-based heating systems.

End users must play a role in load shifting

As end users become generators, they shift from being consumers to “prosumers” and can play a significant role in reducing peak demand. They determine the times when home appliances are used, preheat their houses to save energy, use EV batteries for home energy storage, and implement commercial demand-side response—thus reducing the overall system cost and the cost to society.

Mechanisms for end-user participation in the market are currently underdeveloped and don’t consider the holistic impact on the system. Significant technological innovation will be required not only to simplify and automate electricity use by prosumers, but also to provide real-time feedback on how individual actions affect the overall system (e.g., the price of the next x% of electricity as you plug in your EV to charge). A major public reeducation campaign, along with widespread policy changes, will be required to shift the focus away from the historical emphasis on unit cost, and switching retail energy suppliers to energy efficiency and peak-shaving behaviours.

Systems must be digitalised

The gradual evolution of the utilities market based on a few integrated entities to a decentralised system with tens of millions of individual assets (e.g., residential EVs) will require a fundamental shift in the electricity system operator (ESO) and distribution system operator (DSO) roles. In addition, large-scale system digitalisation that goes well beyond the smart meter rollout will be necessary. Policy frameworks that define industry standards, interoperability, and data security will be critical—and crucial to ensure that today’s skills and capability gaps are closed.

Cybersecurity must be prioritised

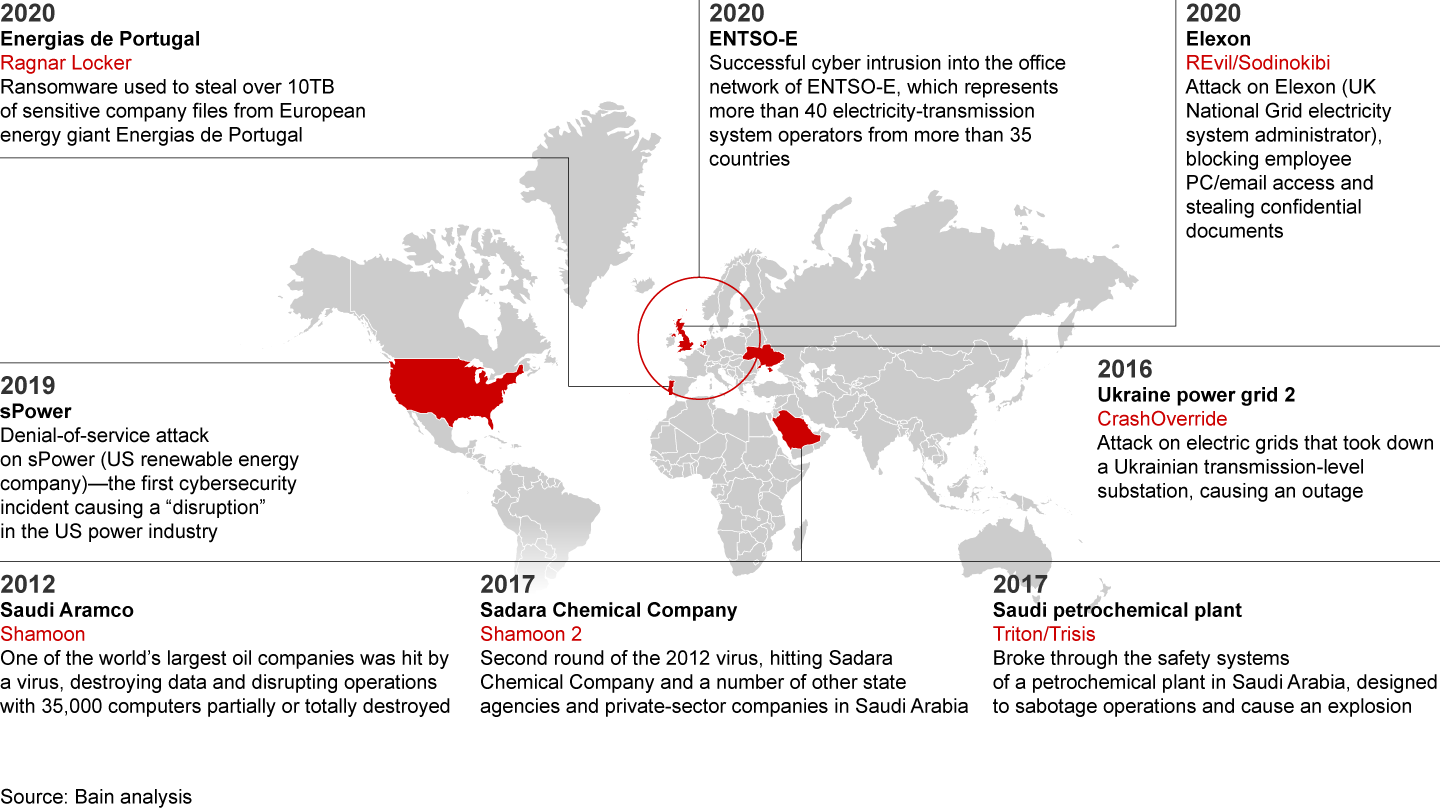

In the past few years, the number of cyberattacks on company assets and national infrastructures have increased, by both state and nonstate actors—and the attacks are growing more sophisticated (see Figure 4). Several states are investing in offensive cyberwarfare capabilities.

With the net-zero plan moving toward the electrification of heat and transport, Great Britain’s electricity system will be even more critical to the physical safety of individuals and the functioning of our economy. The system will be much more distributed, and will have multiple points of entry—and thus increased vulnerability. Security and resilience will need to be built into the system design from the start.

Key stakeholders must fully embrace net zero

The set of stakeholders shaping and operating Great Britain’s electricity system is complex (e.g., BEIS, DEFRA, Ofgem, National Grid ESO, Elexon). Responsibilities are fragmented and not always clear, and stakeholders may have conflicting objectives that don’t align with net-zero facilitation. The recent High Court decision to remove planning consent for Norfolk Vanguard offshore wind development is one example. Rapid progress toward net zero will require urgent realignment among stakeholders. It may also require the creation of an overarching steering body.

Addressing these barriers and progressing along the pathway to net zero will drastically alter the underlying fundamentals of the electricity market as we know it today. We’ll see a broader ecosystem of existing and new participants playing different roles, changed sources of competitive advantage, an increasingly critical role of digitalisation and data, and a much stronger emphasis on collaborating with a new class of prosumers.

As these fundamentals change, those within Great Britain’s electricity market need to consider their roles. To set themselves up for future success, key stakeholders should consider the following questions:

- What’s the best way to support policy makers and other stakeholders in resolving barriers to net zero while avoiding unintended consequences? Which barriers do we understand enough to focus on? Whom do we need to collaborate with in this process to ensure balanced and impartial solutions?

- What barriers will prevent the consumer behaviour changes necessary for net-zero success? What propositions does the industry need to develop to support the new class of prosumers? What role will our business play in those propositions? What capabilities and skills do we need? Whom should we partner with to achieve a whole system approach?

- Who are our future competitors? How will the capabilities that are necessary for success change over time? Which capabilities should we develop in-house, and whom should we partner with for which capabilities?

- How will our business’s risk/return profile change, and what are the implications for shareholder promise and equity story?

- How can we effectively balance running our existing business while changing our business model to position ourselves for the future?

If you consider the number of EVs already on the road in the UK and how many new charging stations are appearing in residential areas every month, you’ll realise how quickly things are already changing. However, we still have a long way to go to build an infrastructure that will allow citizens to use the stored energy in their EV batteries to power their houses during peak demand, incentivise people to charge their EVs at 3 am instead of 6 pm, or dynamically update the price for delivery drivers to charge their EVs based on a street’s existing usage. Everything we know today about how the electricity sector works will change as we move toward our 2050 net-zero goal. But if we hope to achieve meaningful consumer participation in the new system, simplicity must be a cornerstone of its design.